search

date/time

Sun, 3:00PM

overcast clouds

7.6°C

ESE 2mph

overcast clouds

7.6°C

ESE 2mph

| Sunrise | 7:58AM |

| Sunset | 4:50PM |  |

Helen Kitchen

Deputy Business Editor

P.ublished 30th January 2026

business

Lancashire’s ‘Zombie’ Firms Rise Despite Surge In Business Optimism

Latest figures from the Begbies Traynor ‘Red Flag Alert’ report show that 14,752 Lancashire businesses ended 2025 in ‘significant’ financial distress—an 11.6% increase year-on-year. The construction and real estate sectors have been the hardest hit, with distress rising by 13.7% and 13.6% respectively.

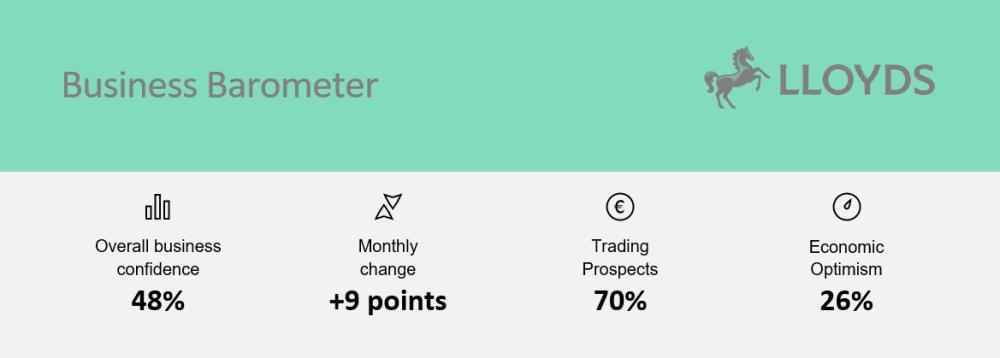

However, the latest Business Barometer from Lloyds presents a more optimistic outlook for the new year. Business confidence in the North West jumped nine points in January to 48%, climbing back above the UK average. Critically, 70% of firms in the region reported high confidence in their own specific trading prospects for 2026.

The Rise of the ‘Zombie’ Firm

The contradiction suggests a "two-tier" economy. Paul Barber, Partner at Begbies Traynor, warns that high energy costs and rising minimum wage requirements are creating a class of ‘zombie’ businesses—struggling firms that are barely surviving.

“This climate is producing a number of businesses that will face closure if they aren’t supported by backers or acquired,” Mr Barber said. He noted that while larger groups can weather the storm, smaller businesses are increasingly unable to handle persistent inflation and pressure from HMRC to settle tax debts.

Investment vs Insolvency

Despite these structural risks, the Lloyds data indicates that healthy firms are ready to go on the offensive. A net balance of 45% of North West businesses plan to increase staff levels this year. Furthermore, 54% of firms intend to evolve their offering with new products, and 38% are looking to invest in technology such as AI.

Jenny France, area director at Lloyds, noted: “Firms have ambitious plans for 2026. This month's data shows that businesses are feeling positive about their own trading prospects in the coming months.”

The regional data highlights a geographical divide in stability. While Cumbria saw a modest 3.7% rise in distress, Preston experienced a sharp 15.4% increase. In Cheshire, the city of Chester saw distress surge by over 20%.

Preston: 1,005 firms (+15.4%)

Manchester: 9,759 firms (+8.5%)

Chester: 913 firms (+20.8%)

Lancashire (Total): 14,752 firms (+11.6%)

Also by Helen Kitchen...

Festival-Inspired Immersive Art Firm Secures £50k To Fuel ExpansionNorthern Talent Tracker: This Week's Key AppointmentsThe Cumberland Secures B Corp Status With Record Sector ScoreNorth East Consultants Secure High-Level Fire Safety QualificationsVoicescape Acquires Enterprise RPA In Manchester Tech Merger